Global Markets Hit All-Time High As Traders Brace For “Phase Two” Optimism

This is where we stand as we enter Monday morning: European markets are firmer this morning, though the FTSE 100 significantly outperforms on a second-wave of UK election optimism. China State Council stated it will continue to suspend additional tariffs…

Election Apocalypse: Investors Fears Very Negative Event a Year From Here and Are Placing Bets to Hedge Themselves

The stock exchange is somehow similar to weather forecasts. You never know what’s going to happen but it’s better to plan ahead and be prepared if a disaster strikes. This is exactly what investors are doing right now as many…

It’s D-Day For The Repo Market: On Monday $100 Billion In Liquidity Will Be Drained – What Happens Next?

Last week’s apocalyptic report by repo market guru Zoltan Pozsar, which for those who missed it predicted that an imminent market crash and loss of control of overnight rates by the Fed would spark nothing short of QE4, sparked an unprecedented panic…

The Destruction of Civilization

Implications of extreme monetary interventions When I was asked to write an article about the impact of negative interest rates and negative-yielding bonds, I thought this is a chance to look at the topic from a broader perspective. There have…

Three Men Arrested In NJ For Running Alleged $722 Million Crypto Ponzi Scheme

United States authorities in New Jersey have announced the arrest of three men who are accused of defrauding investors of over $722 million as part of the alleged crypto Ponzi scheme BitClub Network, per a Dec. 10 announcement from the Department of…

Is Zoltan’s Market Doomsday Imminent? Here Are The Two Things To Watch

In the movie The Outlaw Josey Wales, one of the more famous quotes is, “Don’t piss down my back and tell me it’s raining.” We do not accept the rationale the Fed is using to justify the reintroduction of QE and the…

“It’s About To Get Very Bad” – Repo Market Legend Predicts Market Crash In Days

For the past decade, the name of Zoltan Pozsar has been among the most admired and respected on Wall Street: not only did the Hungarian lay the groundwork for our current understanding of the deposit-free shadow banking system – which has the…

The Danger Of Deeper OPEC+ Cuts

OPEC+ agreed to cut production by 500,000 bpd, sending oil prices higher on Friday. During mid-day trading, WTI was just shy of $60 per barrel, and Brent moved closer to $65. In total, the 1.2 million-barrel-per-day (mb/d) cuts from OPEC will…

Peter Schiff: This House of Cards Will Come Crashing Down On Consumers

Satan generally uses stealth and deception. The success of his plans depends on Christians not waking up to what is happening until it is too late to respond. The House Is Falling… Stocks closed out November on a high note…

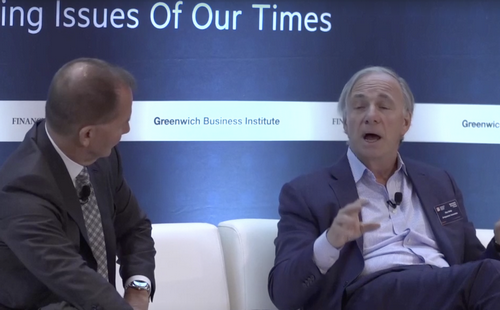

Dalio & Tudor Jones Warn: “We Will Kill Each Other” If Our Broken Economic System Isn’t Fixed

Two hedge fund icons – Bridgewater founder Ray Dalio and Paul Tudor Jones – joined Yahoo Finance for the 2nd annual Greenwich Investment Forum earlier this month. Speaking directly after Connecticut Gov. New Lamont, with whom Dalio is working to bolster Connecticut’s…