Futures Jump Ahead Of Tuesday Stimulus Deadline

Bulls will breathe a sigh of relief that on the 33-year-anniversary of Black Monday (when the Dow dropped 22.6% on this day in 1987) futures are sharply higher, at least for now. Emini futures rebounded from Friday’s drop, undoing most…

The Next Ten Years In Oil Markets

An eventful 2019 wraps up a decade of turmoil in oil markets, in which Brent Crude prices fluctuated from as high as US$125 a barrel in 2012 to as low as US$30 per barrel in January 2016. Geopolitical turmoil, economic growth, soaring U.S….

We Are Entering the Time of “the Perfect Storm”, and Most People Have Absolutely No Idea What Is Ahead of Us.

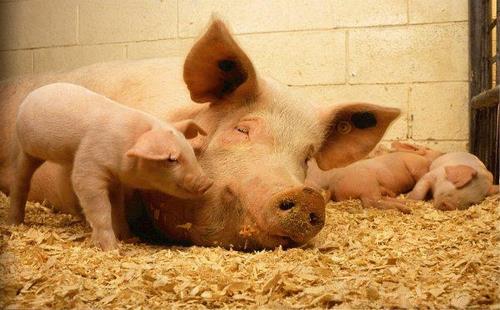

The global pig population is being absolutely decimated by a disease that does not have a cure. African Swine Fever, also commonly referred to as “Pig Ebola”, is raging out of control in dozens of countries all over the globe. It…

Global Markets Hit All-Time High As Traders Brace For “Phase Two” Optimism

This is where we stand as we enter Monday morning: European markets are firmer this morning, though the FTSE 100 significantly outperforms on a second-wave of UK election optimism. China State Council stated it will continue to suspend additional tariffs…

“It’s About To Get Very Bad” – Repo Market Legend Predicts Market Crash In Days

For the past decade, the name of Zoltan Pozsar has been among the most admired and respected on Wall Street: not only did the Hungarian lay the groundwork for our current understanding of the deposit-free shadow banking system – which has the…

The Danger Of Deeper OPEC+ Cuts

OPEC+ agreed to cut production by 500,000 bpd, sending oil prices higher on Friday. During mid-day trading, WTI was just shy of $60 per barrel, and Brent moved closer to $65. In total, the 1.2 million-barrel-per-day (mb/d) cuts from OPEC will…

Dalio & Tudor Jones Warn: “We Will Kill Each Other” If Our Broken Economic System Isn’t Fixed

Two hedge fund icons – Bridgewater founder Ray Dalio and Paul Tudor Jones – joined Yahoo Finance for the 2nd annual Greenwich Investment Forum earlier this month. Speaking directly after Connecticut Gov. New Lamont, with whom Dalio is working to bolster Connecticut’s…

The Food Shortage and the Coming Tribulation’s

There Are Not Enough Pigs in the World to Fill China’s Pork Hole… African swine fever has wiped out herds of pigs all over China – by some estimates more than half – and it now appears the global supply…

Its BS, Fracking Blows Up Investors Again: Phase 2 Of The Great American Shale Oil & Gas Bust

In 2019 through the third quarter, 32 oil and gas drillers have filed for bankruptcy, according to Haynes and Boone. Since the end of September, a gaggle of other oil and gas drillers has filed for bankruptcy, including last Monday, natural…

“It’s As If JPMorgan And Goldman Vanished…”

The equity-ification of the bond market has been closely followed by Bloomberg News and other financial journalists. Unfortunately for the big banks, it’s a trend that has largely been led by fintech firms like TradeWeb and Bloomberg. Many corporate bonds…