Greed refuses to be satisfied. More often than not, the more we get, the more we want. Material possessions will not protect us—in this life or eternally. Jesus’ parable of the rich fool in Luke 12:13–21 illustrates this point well. Again, money or wealth is not a problem. The problem is our attitude toward it. When we place our confidence in wealth or are consumed by an insatiable desire for more, we are failing to give God the glory and worship He deserves. We are to serve God, not waste our time trying to become rich (Proverbs 23:4). Our heart’s desire should be to store up riches in heaven and not worry about what we will eat or drink or wear. “But seek first [God’s] kingdom and his righteousness, and all these things will be given to you as well” (see Matthew 6:25-34).

A former Danske Bank executive at the center of a €200 billion ($220 billion) money-laundering scandal in Estonia was found dead in his backyard in an apparent suicide, according to Eesti Rahvusringhääling (ERR).

Danske Estonia ex-CEO Aivar Rehe’s body found police confirm | News | ERR https://news.err.ee/984145/danske-estonia-ex-ceo-aivar-rehe-s-body-found-police-confirm …Danske Estonia ex-CEO Aivar Rehe’s body found, police confirm The English-language online portal of Estonian Public Broadcasting. All times listed in EET (UTC+2).news.err.ee6:46 AM – Sep 25, 2019Twitter Ads info and privacySee Mcleary ‘s other Tweets

ERR reported on Wednesday that after several days of local police searching for Aivar Rehe, who was in charge of Danske Bank in Estonia from 2006 to 2015, was found dead in the forest near his home at approximately 9:30 p.m. on Tuesday, near the capital of Tallinn.

Estonian Police started searching for Rehe on Monday after he disappeared, reports indicated he was mentally unstable and at risk for suicide.

On Tuesday, local police told ERR that he was “a threat to his own life and well-being.”

By Wednesday, ERR confirmed that all signs pointed to suicide, well, that is at least what the local media is reporting.

Danske Bank’s Estonian branch is at the heart of one of the largest money-laundering scandals, with €200 billion ($220 billion) of suspicious funds flowing from Russia, Moldova, and Azerbaijan, for at least a decade. The amount of money that was transferred was equivalent to 10 times Estonia’s GDP, mostly originating from Russia.

The scandal has led to a criminal probe into Danske Bank’s Estonian branch, along with top bank executives in Europe and the US. Prosecutors told ERR that Rehe wasn’t a suspect.

Ten former employees, most low/mid-tier ones, are suspects in the investigation. Prosecutors have already charged the bank’s former chief executive and chief financial officer, Thomas Borgen and Henrik Ramlau-Hansen.

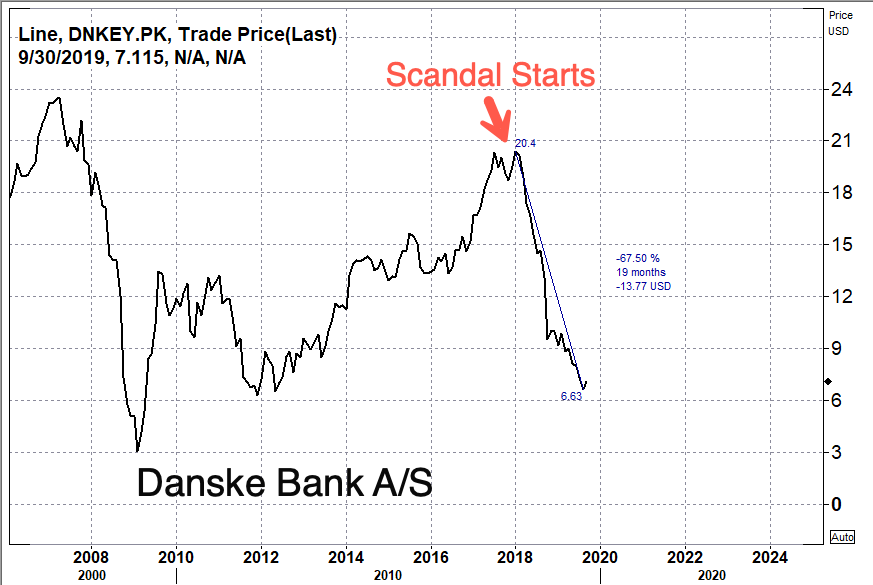

Danske Bank holds about 50% of Danish people’s savings, has seen at least 67% of its market capitalization wiped out in the last 19 months since the scandal emerged in 2017/2018.

Earlier this year, he said in an interview that all the necessary compliance tools were in place to deter money-laundering in the bank. He told the public to await the outcome of the investigation into the bank before drawing any conclusions. He also said anti-money-laundering laws back then were “were significantly different” from ones in 2019. Source

StevieRay Hansen

Editor, Bankster Crime

The people spreading concrete information on the dangers of globalism are accomplishing far more than those sitting around buying bitcoin or passing around Q-cult nonsense.

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM…

#Fraud #Banks #Money #Corruption #Bankers

“Have I therefore become your enemy by telling you the truth?”