Don’t forget, the Spanish Flu pandemic lasted from January 1918 to December 1920.

Facebook Twitter Pinterest Email

Fear of the coronavirus is causing shutdowns on a global scale like we have never seen before. Just about every major sporting event that you can think of has been either canceled or postponed, schools and universities are keeping students away, global tourism is absolutely collapsing, churches are being shuttered, conferences and festivals are being taken off the calendar, businesses are asking workers to work from home, and even Disneyland is being closed down. Over the past several days the wave of closings and cancellations has become an avalanche, and all of our lifestyles are going to be dramatically altered for the foreseeable future.

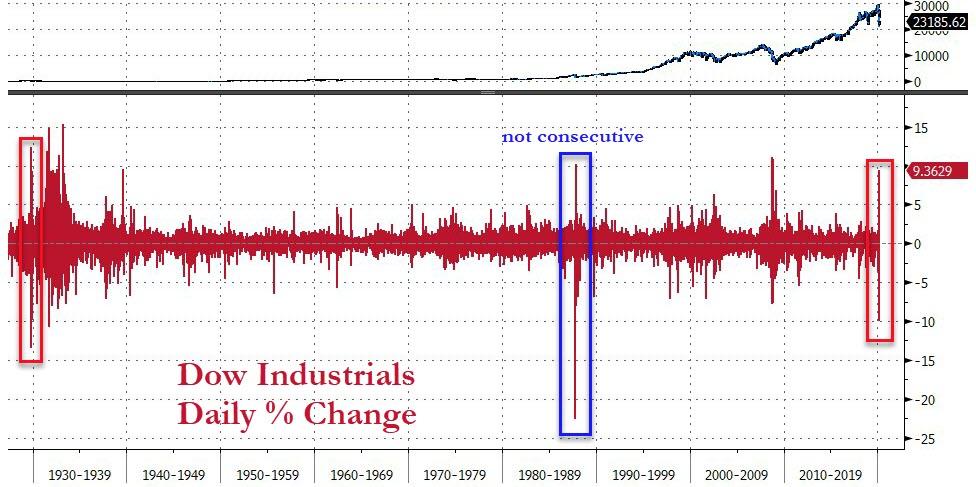

I think that Wall Street is starting to grasp the reality of what we are potentially facing. On Thursday, we witnessed the largest single day stock market point crash in American history. The Dow Jones Industrial Average was down 2,352 points, and that shattered the “old record” of 2,013 points that was just set on Monday. Overall, the Dow was down 9.99 percent, and that was the biggest percentage decline since the nightmarish stock market crash of 1987.

Incredibly, European stocks did even worse on Thursday. In fact, it was the worst day ever for stock markets in Europe.

We have never seen a time when the entire western world has been in the process of literally shutting down simultaneously. The following is how a Slate article described what we are currently witnessing…

Virtually every activity that entails or facilitates in-person human interaction seems to be in the midst of a total meltdown as the coronavirus outbreak erases Americans’ desire to travel. The NBA, NHL, and MLB have suspended their seasons. Austin’s South by Southwest canceled this year’s festival and laid off a third of its staff. Amtrak says bookings are down 50 percent and cancelations are up 300 percent; its CEO is asking workers to take unpaid time off. Hotels in San Francisco are experiencing vacancy rates between 70 and 80 percent. Broadway goes dark on Thursday night. The CEOs of Southwest and JetBlue have both compared the impact of COVID-19 on air travel to 9/11. (That was before President Trump banned air travel from Europe on Wednesday night.) Universities, now emptying their campuses, have never tried online learning on this scale. White-collar companies like Amazon, Apple, and the New York Times (and Slate!) are asking employees to work from home for the foreseeable future.

On top of everything else, March Madness has been canceled for the first time ever…

The NCAA will not crown a men’s or women’s basketball champion in 2020.

Conceding defeat to the COVID-19 virus and a cascade of uncertainty about how bad its ongoing spread might impact public health across the United States, the NCAA announced Thursday all its winter and spring championships have been canceled after a series of moves across multiple sports leagues that foreshadowed the eventual arrival at this decision.

I can’t even imagine the heartbreak that many of those athletes are feeling right now.

They have been training all of their lives to fight for a championship, and now that opportunity has been taken away.

Sadly, just about every major sporting event has either been canceled or will be canceled shortly.

Of course, the business world has been thrown into chaos as well. Companies all across America are going to great lengths to minimize human interaction, and all sorts of non-essential activities are being eliminated. Source themostimportantnews.com

Even a New York seminar entitled “Doing Business Under Coronavirus” has been canceled because of the coronavirus.

The financial and human SORROW and distress is hard to swallow.

The virus itself has not caused the DESTRUCTION; the response to it has, at this point. Put on the scales versus other viruses, the INFLICTED MISERY is far less than even the seasonal flu. The PREEMPTIVE ACTION is taken, under the premise that this could BUILD UP and spiral into an INFERNO, has ruined the economy.

Entire countries are FROZEN, economically. The ramifications of this are hard to really explain. This will take years to be studied and learned from. So many mistakes have been made and the financial LOSSES are mounting.

Courtesy: Zerohedge.com

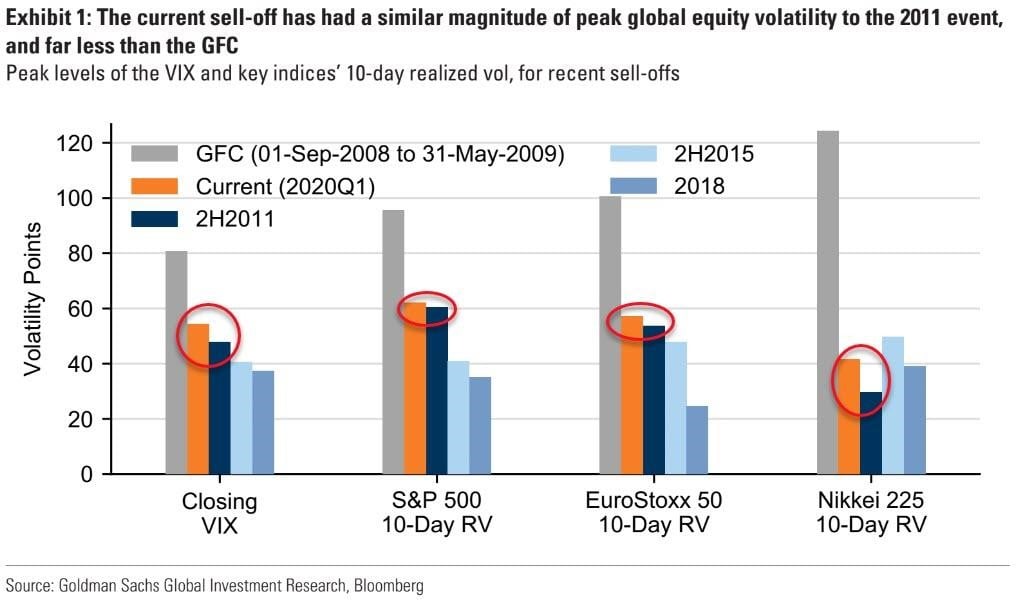

As you can see, in order of magnitude, indices could shed an ADDITIONAL 15%-20%, on top of what has already been MUTILATED.

For 11 years, earnings have grown by 13%/annum and prices have SOARED by 16%/year; this CYCLICAL bull market is TOAST.

Freshly slapped in the face by a US stock market crash which fell harder and faster than even the 1929 version.

We watch the growing pandemic increasingly shut down economic activity across the world, requiring a resetting of virtually all prices and values still ongoing. Add to that, a supposed oil price war, which may be a clear signpost to the end of the fiat petrodollar era <- see the 18-minute mark there for the collapsing road we have been on some time now.

Will we again revisit a Gold Oil Ratio near 100?!

This video below is a brief examination of how deep this deflationary beating may get. And how large the bailouts may get.

Most are completely unprepared for its potential duration.

Precious metals and speculators betting long in the COMEX and NYMEX price discovery markets were also taken to the woodshed this week.

Gold held up best in value. Below we drill into historic levels of gold bullion value appreciations we may be revisiting again.

The spot price which underlies the pricing of silver bullion finally fully rolled over in the face of this deflation and deleveraging.

The gold-silver ratio is now around 104, and we’ll put that into historical context later this episode.

The same deflationary spot price beatdown occurred this week with both platinum and once record price parabolic palladium.

Amazingly on paper at the moment, the gold-platinum ratio is now over 2.

Just yesterday we had a stock sell-off about -10%,

that was second only to Black Monday in October 1987 when

the S&P500 lost -22% of its value in 1 day.

Today we had a stock market rebound up of over 9%.

Trump autographed this latest PPT ramp as if it were cool another perversion to not-so-humble brag over.

Ok, I thought for sure this was BS, but I just found the clip. Yes, DJT sent Lou Dobbs a signed copy of today’s one-day stock market chart

I … can’t …. even ….. begin to understand what’s going on

Someone pls tell me this is not real.

https://www.mediaite.com/news/lou-dobbs-shows-off-trump-autographed-printout-of-2000-point-stock-market-rise-one-day-after-2300-point-drop/ …Lou Dobbs Touts Trump-Autographed Stock Market PrintoutLou Dobbs shows off Trump-autographed printout of 2,000-point stock market rise sent by the White House…one day after its record 2,300-point dropmediaite.com

James Henry Anderson@jameshenryand

1933 Gold Confiscation to

1934 Gold Reserve Act Exchange Stabilization Fund to

2020 PPT Potus Autograph

It’s only going to get weirder as this unravel$https://twitter.com/jameshenryand/status/1238653165827952640 …James Henry Anderson@jameshenryandMnuchin’s#UnlimitedLiquidity

comment today was probably something

Jim Cramer advised him to usehttps://youtu.be/bmC8k1qmM0s

When a 1987 style stock mkt

meltdown is happening

call Jimbo,https://twitter.com/jameshenryand/status/1238279970658693120 …18:43 AM – Mar 14, 2020Twitter Ads info and privacySee James Henry Anderson’s other Tweets

This kind of day to day volatility is not the typical sign of a healthy financial or equity market.

Demographic and fundamental factors are a lot different now than they were back in 1987.

Yet still, some hopeful stock rebound bulls think the private Central Bank and the Federal Government will create and inject more trillions of fiat Federal Reserve notes, driving our return back to all-time nominal highs.

—

As fallible human begins, it typically takes about three generations or roughly ninety to one hundred years of time for most to forget big and even small lessons of our forefathers.

The last time we had a pandemic on this scale was the Spanish Flu. And that lasted for some two years of time and came in two waves killing millions across the world.

Just yesterday macro analyst and founder of Real Vision was on Yahoo Finance discussing downside potentials to come. This is not meant to scare you, merely remind us all, that this could last longer than many thinks is even possible.

—

This past weekend, a supposed price war in oil broke out, and the Gold Oil Ratio was driven to new all-time full fiat petrol dollar system highs.

The battle appears to be between the Russian Federation, Saudi Arabia, and US Shale oil frackers.

The price per barrel of WTI crude oil is now in the low $30s and questions remain not merely regarding possible US shale oil bailouts, but more so geopolitical strategy, and regarding gold’s role.

In the fullness of our nation’s history during deflationary eras following when silver was demonetized that the gold oil ratio rose to nearly 100.

Hard to know how much higher this ratio might go now that we apparently, not foreigner governments, are busy buying our escalating IOUs.

–

Regarding gold’s strength of late, it is questionable how much higher this gold-silver ratio may run to.

The all-time record high for the gold-silver ratio occurred in 1933 when the gold-silver ratio reached 134 as freshly confiscated gold got rigged to $35 oz and silver were only a penny higher than its all-time low level priced at a mere 26¢ per troy ounce.

–

The US Mint is now temporarily sold out of Silver Eagle Coins. The most popular silver bullion coins in the world, have temporarily sold out citing rates of sales that exceed 3Xs of what was sold last month.

While we still have bullion supplies on our shelves here at SD Bullion, product premiums are escalating due to supply constraints versus outsized demand at the moment.

What is past is likely indeed Prologue for Precious Metals.

As in the fall of 2008, this industry is typically not able to handle the demand increase of 5X to 10X over months or more durations of time.

This industry has also suffered many silver and gold refinery bankruptcies over the last few years and that has exacerbated ongoing supply constraints.

If spot prices stay or perhaps lower in the weeks to come, you can expect more delivery delays and product sellouts.

For now, our team at SD Bullion is working 7 days a week processing and shipping out hundreds and thousands of customer orders every day.

—

To finish this week’s video update, we are going to hear some of the silver bull and billionaire bond trader Scott Minerd’s thoughts from yesterday while speaking on CNBC.

Specifically on which fiat Federal Reserve and federal government bailouts and stimulants are to come from all this (the debate appears to be not should we but more so how much and where to funnel the next trillions in market proppings).

While late this week the Federal Reserve upped their seemingly ever-expanding overnight REPO operations to trillions of daily aggregate loans and with multi month-long durations.

The US Treasury head is now using terms like Unlimited Liquidity and now have a listen to billionaire silver bull, Scott Minard thinks may be coming our way.

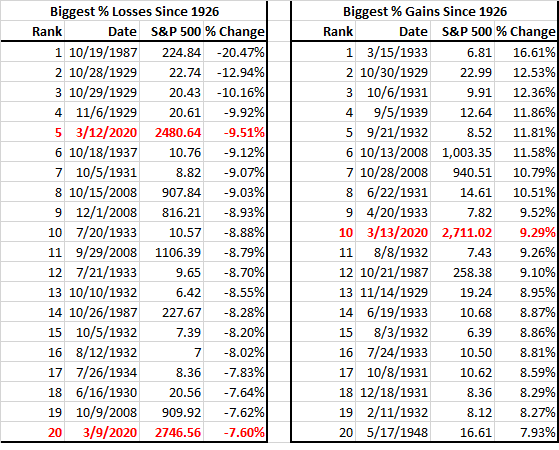

While this week had many superlatives – like being the fastest collapse from peak to bear market ever, fastest credit spread decompression ever, biggest weekly jump in VIX ever, and largest 3-week decline in oil prices ever – one stands out as rather more ominous than others…

Three of five days this week made the list of top 20 daily gains of losses in history…

Top 20 biggest daily gains and losses back to 1926.

3 of 5 days this week made the list!

29, 32, 33, 87, 08, 20 had weeks with multiples.

All led to profound changes in either markets and/or the economy.

I suspect 2020 will too. What that will be is still a work in progress.

3484:12 PM – Mar 13, 2020Twitter Ads info and privacy165 people are talking about this

Pimco’s Fels Says It’s Not the Time to Sell Bonds as Yields Are Headed Lower

But even more unusual this week was the fact that the market had back to back 9% swing days…

The last time this occurred was the three days ending October 30, 1929…

Receive a daily recap featuring a curated list of must-read stories.

And this is what happened next…

But it could never happen again, right?

StevieRay Hansen

Editor, Bankster Crime

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

https://bankstercrime.com/coronavirus-triggers-biggest-shock-to-oil-markets-since-lehman-crisis/

“Have I, therefore, become your enemy by telling you the truth?”

Oil Drop, Coronavirus, Fraud, Banks, Money, Corruption, Bankers. Stock Market