When all you have is a hammer, everything looks like a nail. Abe Maslow, the same fellow who developed the “hierarchy of needs” paradigm in human psychology, popularized that phrase to warn scientific researchers about the perils of using tools inappropriate to the task at hand.

It is an especially relevant observation when it comes to Federal Reserve monetary policy since the hammer of interest rates is the central bank’s chief tool. Balance sheet expansion, such as that used to combat recent repo market tensions, also rattle around in their toolbox, of course. But rate policy is their go-to implement to achieve the goals of stable prices and economic expansion.

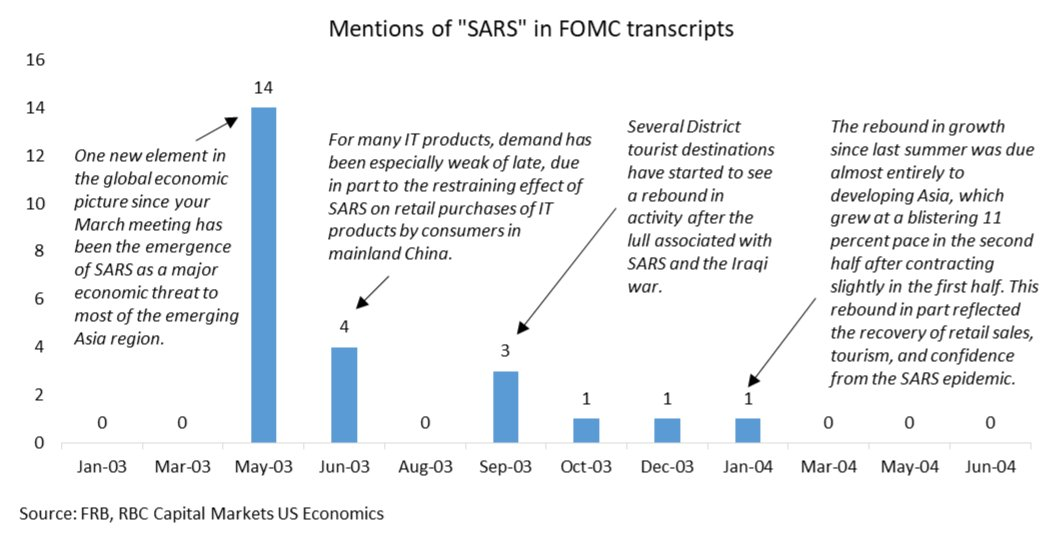

With this week’s FOMC meeting and Chair press conference, the Fed’s hammer will see a fresh test, and one for which it is hardly suitable: addressing the growing global economic uncertainty around the Wuhan coronavirus. As we outlined last week in our review of a Davos panel on the subject, any vaccine is at best months away. In the interim, China is aggressively moving to quarantine entire cities and limiting mass gatherings. Cases are cropping up around the world, and while the illness seems to be less deadly than SARS it is spreading more quickly at present.

Capital markets are beginning to discount the possibility that the Fed will use their interest rate hammer to offset growing economic uncertainty caused by the outbreak:

#1: 2-year Treasury yields broke to below 1.5% on Thursday to 1.486% and closed Friday at 1.495%, which we interpret as a response to concerns about near term global growth. Why that’s an important development.

- 2-years are keenly sensitive to a market opinion about future rate policy.

- This is the first time they are below 1.5% since September/October’s global bond rally related to fears over US-China trade talks and recession worries.

- Yields here are now just below the current 1.50% – 1.75% benchmark for Fed Funds, implying that the central bank will cut interest rates.

#2: Fed Funds Futures have moved noticeably in the last week, with increasing odds for a 2H 2020 rate cut (or two):

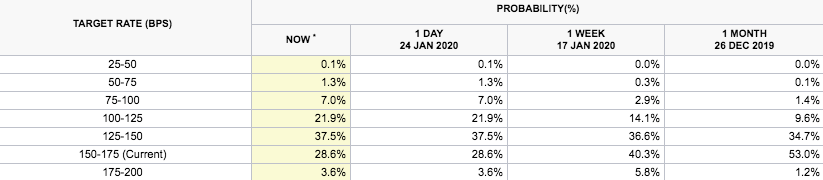

- Futures discount stable Fed Funds through Q1. The odds that rates remain unchanged through the March meeting have not budged in the last week and run 84% – 86%.

- The story changes when you look at the odds around the June 2020 FOMC meeting. A week ago the probability of a rate cut by then was 14%; now it is 25%.

- Last week’s trend to higher expectations for a 2020 rate cut increases as you look at September’s contracts. A week ago, the odds that rates would be lower than today were 37%; now they are 50%.

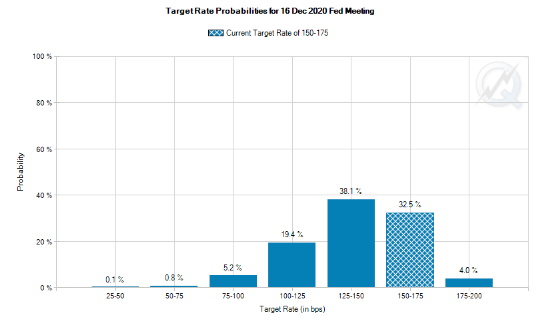

- Fast forward to the December 2020 meeting (chart below, courtesy of the CME FedWatch Tool), and the odds that the Fed cuts rates this year rose last week to 68% from 54%. Moreover, the probability that the Fed cuts by 50 basis points or more rose from 17% to 30% last week.

In summary: it is far too early to tell what effect the coronavirus may have on the global/US economy, but markets are increasingly assuming the economic effects of this public health crisis will inform US central bank policy. While the Fed’s rate tool obviously plays no role in finding a treatment or vaccine for the coronavirus, investors expect the FOMC will do its best to inoculate the US economy against its effects. It is, however, still a hammer… Source ZeroHedge

StevieRay Hansen

Editor, Bankster Crime

“debtors are hostage to their creditors.”

MY MISSION IS NOT TO CONVINCE YOU, ONLY TO INFORM YOU…

The Birth Pains Are Growing Stronger….

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

My name is Steve Meyers and I need to share a vision and warning that the Lord showed me back in April 2007….

Many of you will ask why I waited so long to share the warning. I didn’t. I shared the story with everyone that would listen from pastors to friends to family to colleagues. Immediately following the initial vision, I called a close friend. I told him to sit down that I had something to tell him. I needed it documented as I knew this was supernatural and from God. As I witness events unfolding today, I need to share the vision again.

The risk of loss in trading futures and options on futures can be substantial. The author does not guarantee the accuracy of the above information, although it is believed that the sources are reliable and the information accurate. The author assumes no liability or responsibility for direct or indirect, special, consequential or incidental damages or for any other damages relating or arising out of any action taken as a result of any information or advice contained in this commentary. The author disclaims any express or implied liability or responsibility for any action taken, which is solely at the liability and responsibility of the user. Steve Meyers, StevieRay Hansen

People’s hearts are troubled, their minds are in a state of confusion, the Bible tells us a time of great delusion that will come upon the people, that time has arrived, the politicians must come up with more significant and more believable lies in order to bring on the antichrist, we have entered the doorstep Tribulation.

“Unless God has raised you up for this very thing, you will be worn out by the opposition of man and devils”…

Fraud, Banks, Money, Corruption, Bankers, Powerful Politicians, Businessmen

![]()